Rural and critical access hospitals have always carried a heavier load with fewer resources. Smaller patient volumes, greater dependence on Medicare and Medicaid, ongoing staffing shortages, and rising operating costs leave very little room for error. As we move toward 2026, those pressures are not easing. They are becoming more pronounced.

One issue continues to sit quietly at the center of many rural hospitals’ financial struggles: revenue cycle delays. For large health systems, delays are often an inconvenience. For rural hospitals, they can quickly become a serious financial risk.

Thin margins leave no room for delay

Most rural hospitals operate with extremely tight margins. Even small disruptions to cash flow can create real strain. Claims delayed because of missing information, eligibility issues, or unresolved denials can quickly turn into payroll stress, postponed investments, or difficult operational decisions.

In many cases, care is delivered efficiently and appropriately, but payment does not follow in a timely manner. The longer that gap exists between care delivery and reimbursement, the harder it becomes for rural hospitals to stay financially stable.

The work is getting more complex

Revenue cycle operations are more complicated than they were even a few years ago. Patient responsibility continues to rise. Payers are more aggressive with reviews and documentation requirements. Medicare and commercial payer rules change frequently. At the same time, rural hospitals are facing persistent shortages in billing, coding, and patient access staff.

These teams are being asked to manage growing complexity with limited bandwidth, often using systems that were not built for today’s environment.

Small issues turn into big problems

Revenue cycle delays rarely start as major breakdowns. They usually begin with small issues at the front end, such as incomplete registration or missed eligibility verification. Those issues follow the claim through the process, leading to rework, denials, longer accounts receivable cycles, and increased bad debt.

Over time, these inefficiencies quietly chip away at financial performance, even when patient care and volumes remain steady.

Many rural hospitals are paying too much for too little

Adding to the challenge is the cost of the technology itself. Many rural hospitals are paying enterprise level pricing for practice management and revenue cycle platforms that do not deliver meaningful financial improvement.

These systems often come with high licensing fees, costly upgrades, and added modules that increase expense without reducing workload. Despite the investment, staff are still relying on manual processes, limited visibility, and workarounds just to keep claims moving.

For hospitals operating on narrow margins, paying more each year while still dealing with revenue delays is not sustainable.

Rural hospitals do not need oversized platforms built for massive health systems. They need technology that is practical, efficient, and aligned with the way their teams actually work.

Technology choices matter more than ever

Today’s revenue cycle platforms must do more than submit claims. They need to support staff by simplifying workflows, identifying issues early, and adapting quickly to payer and regulatory changes. When systems fail to do this, the result is slower cash flow, higher administrative burden, and growing frustration for already stretched teams.

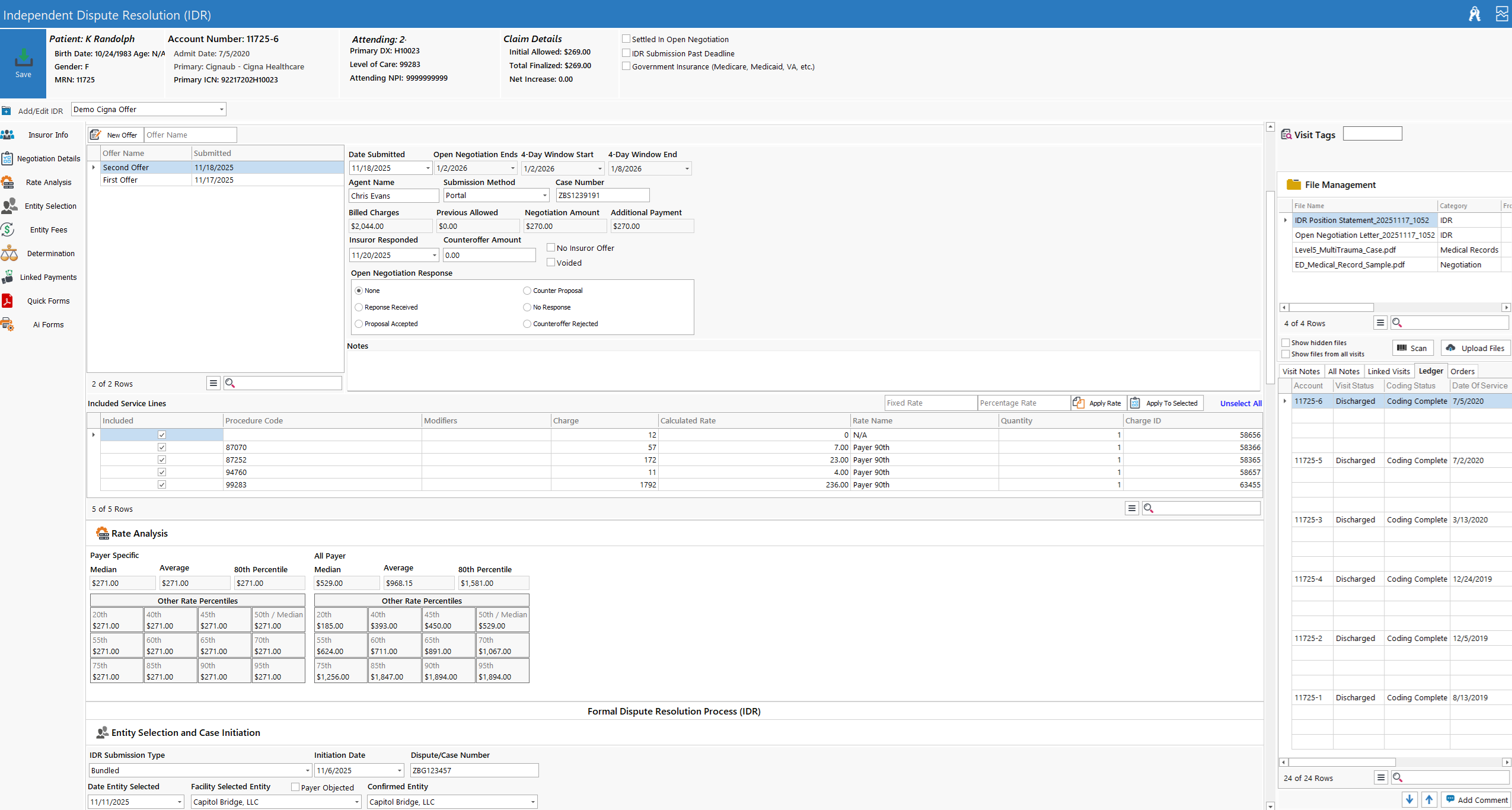

How GoRev helps rural hospitals move faster and spend less

GoRev was built with real world healthcare operations in mind. For rural and critical access hospitals, that means technology that reduces friction instead of adding to it.

GoRev helps hospitals submit cleaner claims, reduce denials, and gain clearer insight into where revenue is getting stuck. Just as important, it helps teams do more without adding staff or increasing complexity.

Many rural hospitals are also finding that they can achieve better financial results while spending less on their revenue cycle platform. By focusing on what actually drives performance and removing unnecessary features and cost, GoRev offers a more sustainable alternative to expensive legacy systems.

In an environment where every dollar matters, getting better results for less money is not a luxury. It is a necessity.

Looking ahead to 2026

The financial environment for rural hospitals is unlikely to improve in the near future. Organizations that continue to tolerate revenue cycle delays and high technology costs will face increasing pressure.

Those that invest in tools designed to simplify operations, improve accuracy, and accelerate cash flow will be better positioned to continue serving their communities.

Rural healthcare cannot afford slow systems.

And it cannot afford to pay a premium for platforms that do not deliver.