The world of medical billing is complex, but when disputes arise between healthcare providers and insurance companies over payment, the process can become even more daunting. The Independent Dispute Resolution (IDR) process was designed to bring clarity and fairness to these situations. However, managing the documentation, timelines, and evidence required can be overwhelming, especially without the right tools in place.

In this post, we’ll break down how the IDR process works and explore how effective billing software can streamline your success through every step.

What Is the IDR Process?

The Independent Dispute Resolution (IDR) process is a formal method to resolve disputes between providers (or facilities) and health plans over out-of-network payment amounts. It was introduced as part of the No Surprises Act, which aims to protect patients from unexpected medical bills.

When Does It Apply?

- The patient received out-of-network care at an in-network facility.

- There is a disagreement between the provider and payer over the reimbursement amount.

- A prior negotiation attempt failed or was not initiated.

Once a provider and payer fail to reach an agreement, either party can initiate IDR through a federal portal.

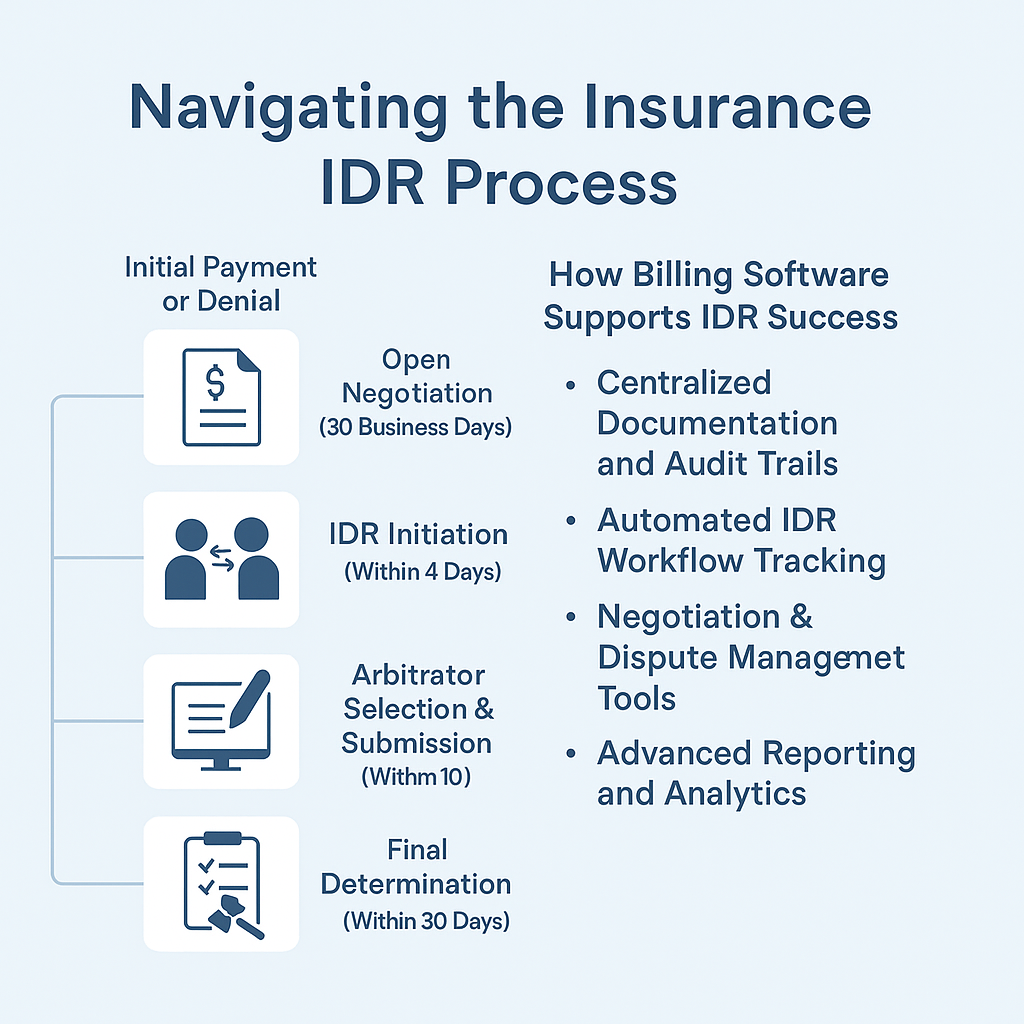

Key Phases of the IDR Process:

- Initial Payment or Denial: The insurer makes a payment or denies the claim.

- Open Negotiation (30 Business Days): Both parties try to resolve the payment dispute informally.

- IDR Initiation (Within 4 Days of Failed Negotiation): If unresolved, either party can request arbitration through the IDR portal.

- Arbitrator Selection & Submission (10 Days): Both parties submit their proposed payment amounts and supporting documentation.

- Final Determination (Within 30 Days): An arbitrator chooses one of the proposed amounts based on the documentation provided.

Challenges Providers Face During IDR

The IDR process, though designed to be fair, presents logistical challenges:

- Tight timelines and strict deadlines

- Detailed documentation and evidence requirements

- Lack of transparency into payer negotiations

- Tracking and managing multiple open disputes simultaneously

These hurdles make it essential for providers to be organized, prompt, and data-driven in their approach.

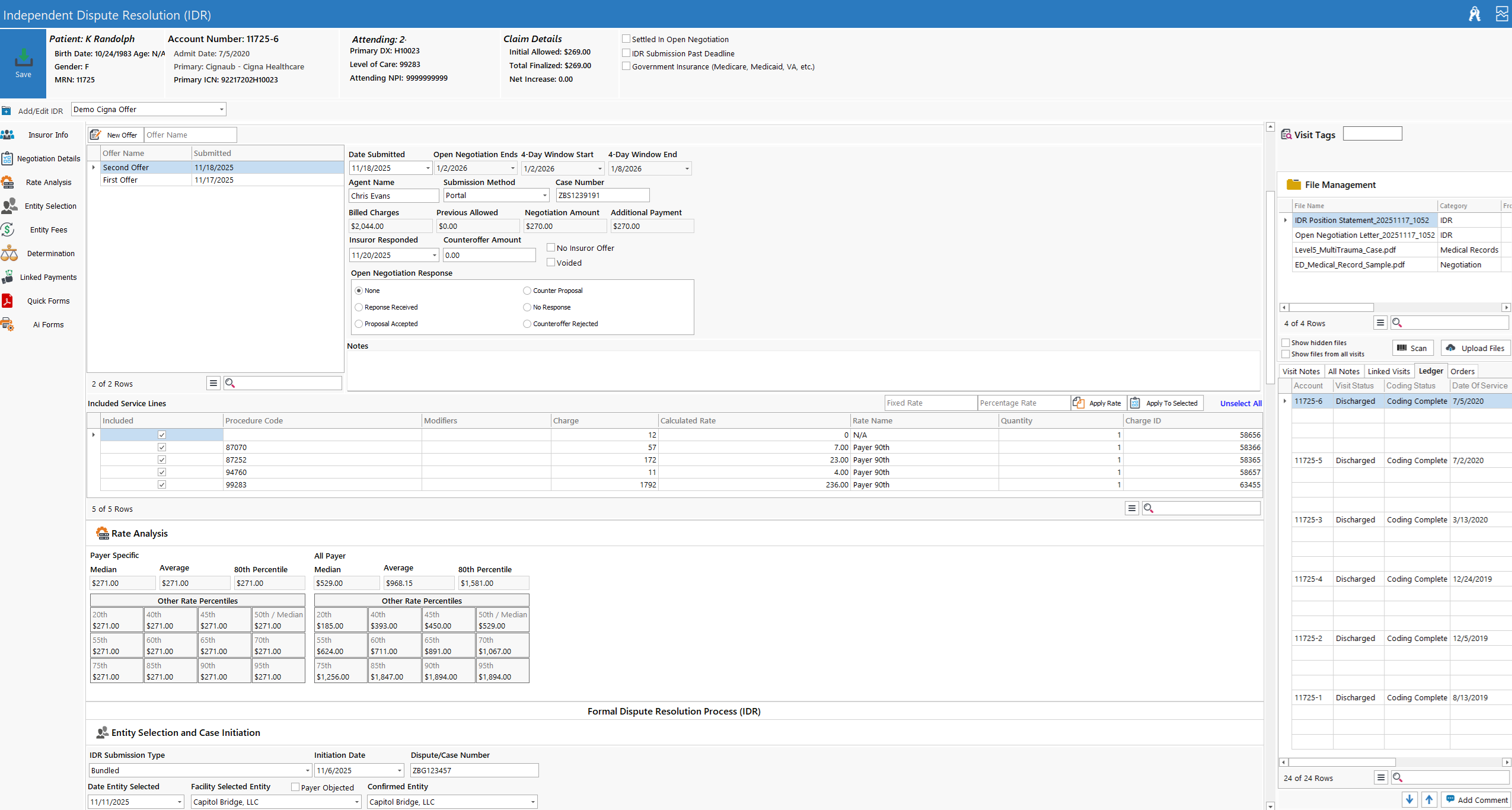

How Effective Billing Software Supports IDR Success

Modern billing software can be a game-changer in how providers handle the IDR process. Here’s how:

- Centralized Documentation and Audit Trails

An effective billing platform captures all communications, claim details, payer responses, and payment data in one place. This is crucial when gathering proof for arbitrators, such as comparable payments, CPT coding justification, and historical reimbursement rates.

- Automated IDR Workflow Tracking

With built-in workflow automation, billing platforms can track each claim’s progress—from initial submission to negotiation to IDR filing, while automatically flagging key dates and sending alerts for critical deadlines.

- Negotiation & Dispute Management Tools

Smart billing systems offer templates, notes, and communication logs that allow billing teams to document negotiation attempts, an essential prerequisite for IDR initiation. They also support bundling related claims for dispute, improving the efficiency of submissions.

- Advanced Reporting and Analytics

Robust analytics tools can surface patterns in payer behavior, denial trends, and success rates in negotiations vs. IDR outcomes. This helps refine strategy, estimate likelihood of success, and justify proposed reimbursement amounts with real data.

- Improved Cash Flow Predictability

By managing disputes more effectively and reducing revenue delays caused by long arbitration cycles, billing software helps providers maintain a healthier cash flow and avoid write-offs.

Conclusion

The IDR process is a powerful tool for ensuring fair compensation in the wake of the No Surprises Act, but it requires discipline, documentation, and strategic insight. With the right billing software, providers can transform the IDR journey from a stressful scramble into a well-oiled process—ensuring they stay compliant, proactive, and paid fairly.

Whether you’re navigating a single claim or managing hundreds of disputes, investing in billing technology tailored for today’s complex payer environment is no longer optional, it’s essential.

GoRev And HaloMD

- Data Exchange & Eligibility Matching

- Claims Identification: The billing software flags claims that are eligible for IDR based on payer responses (e.g., initial payment or denial).

- Data Push to HaloMD: Claims details (including billing codes, service dates, provider and payer info, and documentation) are formatted and submitted to HaloMD.

- API or Portal-Based Submission

- API Integration (if available): Some billing software may use APIs provided by HaloMD to submit IDR cases programmatically.

- Manual Upload with Assistive Tools: If APIs aren’t available, the software might generate pre-populated forms or packets for upload to HaloMD’s web portal.

- Status Tracking and Updates

- Case Monitoring: Once submitted, HaloMD updates status through its portal. Billing software can poll for updates or allow users to input status manually.

- Notifications: Automatic reminders or alerts are generated within the billing software to inform staff of required actions or updates.

- Decision Import

- Outcome Recording: When an IDR decision is reached, HaloMD’s decision can be imported into the billing system, updating the claim and potentially triggering adjustments or additional appeals.

Considerations for Custom Integration

- Security & HIPAA Compliance: All data exchanges must be encrypted and logged per HIPAA standards.

- Document Handling: Scanned EOBs, medical records, and narratives often accompany IDR cases; software must support attaching and transmitting these securely.

- Audit Trail: Full documentation of submission dates, statuses, and outcomes is critical for regulatory compliance.

Learn more about how GoRev can transform your revenue cycle here: https://gorev.com